With the number of products available, teling your salespeople what to focus on is getting harder and harder. How do you as a leader guide your team to sell the best products for the business?

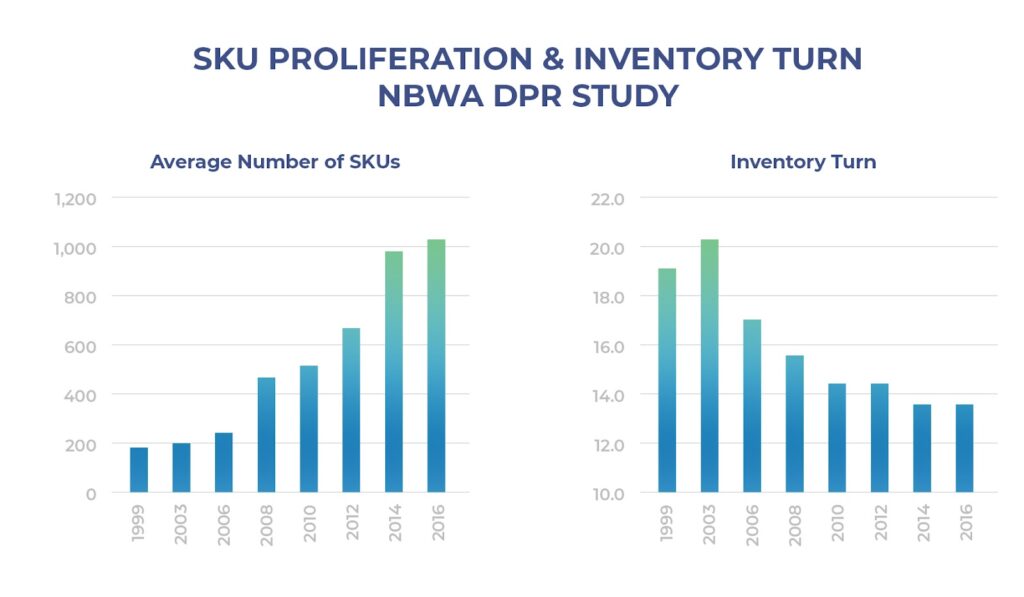

In the beverage business, we have had a doubling of SKUs that has resulted in the halving of our turn of inventory.

We’re now asking salespeople to look at over 1000 options for what to sell in a retailer, vs. under 200 in 1999.

How are they supposed to choose, and how do you make sure they make the right decision?

A box is just a box, right? 📦📦📦

We still share sales data in a one-dimensional fashion, using reports that equalize everything into a case equivalency (CE). 280oz’s of carbonated water, hopped, fermented, and bottled: it’s all the same. A CE is just a CE, right? Then, it’s all just marketing from there to generate pull in the marketplace.

That was the way back in the 1990’s when distributors had on average 200 SKUs, but that’s not the case now.

Now we have over 1000 SKUs on average, and even our premium and value brands have a plethora of packages to offer consumers. With all this change, it begs the question – how are our sales teams thinking about the different values of these SKUs to our bottom line?

Golden cases are sitting in your warehouse 💸💸💸

We have all been told by consultant after consultant that the goal of a distributor is to increase Gross Profit per delivery, and that is the way to drive money to our bottom line. That is 100% correct.

But here’s the thing—growing GP per delivery is not just an operations game, nor is it a “let’s add a new brand or supplier” game.

With SKU explosion, craft slowing, the seltzer boom, and various other reasons, you need a better way to get your sales team to understand why one box is better than the next for your business.

But I have a value driven market…

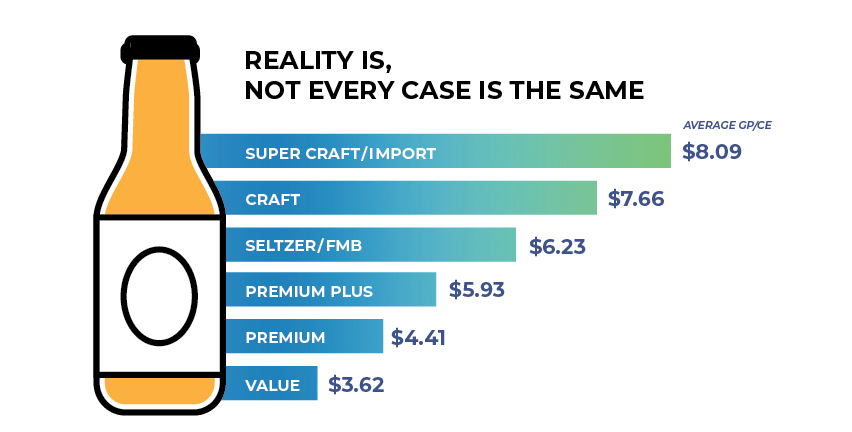

As you look at the graph above, we can all understand that crafts and imports bring more GP/CE to a distributor. But what if you have a value-driven market and less opportunity to sell craft and import?

Here’s what most sales teams don’t realize: There is a huge range in GP/CE in one brand family, even value brands. This is why we preach that not all boxes are created equal.

A value brand example 💰💰💰

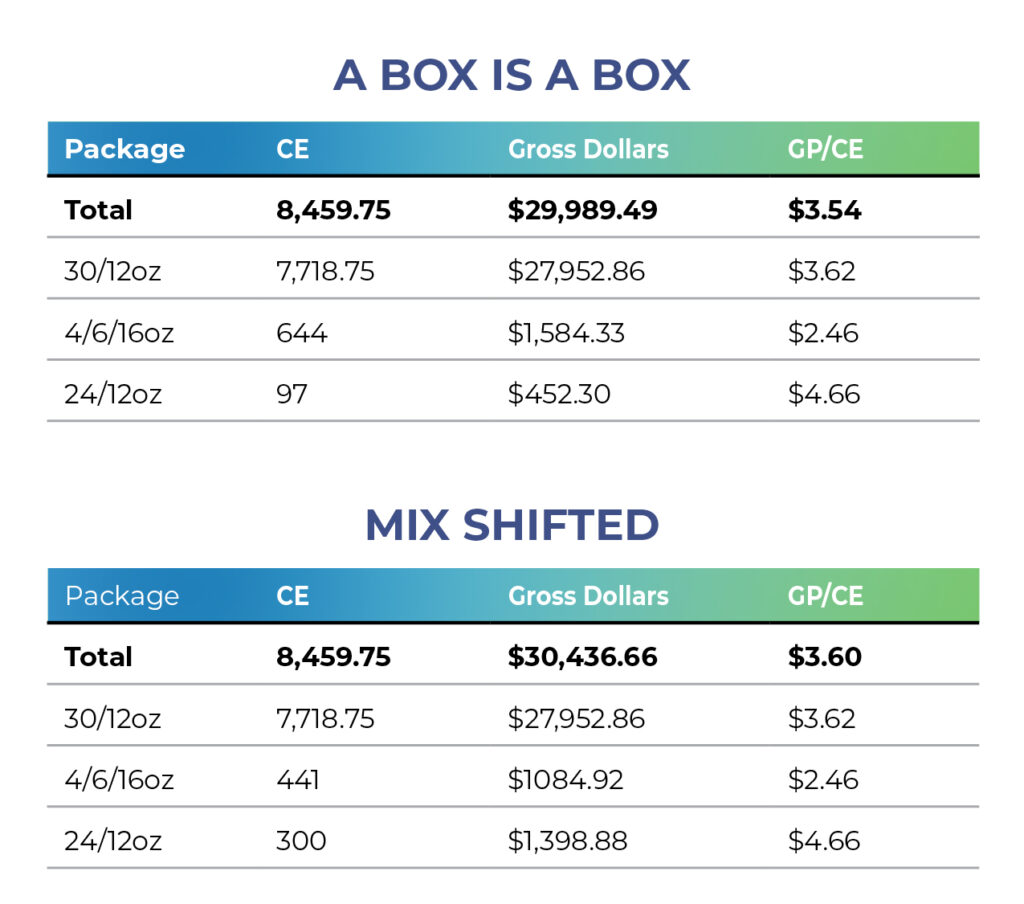

Here is GP/CE on different package sizes of the same value brand:

- $2.46 gp/ce on a 6pk 16oz cans

- $3.61 gp/ce on 30pk cans

- $4.67 gp/ce on 24pk cans

Typically, we see sales teams being compensated by the number of boxes sold, or percentage of an invoice, and on a point sheet.

But in reality— we want them selling 24pk cans, not 6pk 16oz cans, if given the opportunity. It’s much more profitable.

My question to you is how does the sales rep know what optimizes profit for your operation if no one tells them?

When a sales rep is only shown sales volume data (which is basically all we talk about) and is incentivized to sell volume alone they will place, market, display, and feature the product that is going to result in achieving those incentives at the highest level.

In this case, that is the 16oz cans that are losing your operation $2.21 in opportunity GP/CE.

Get your $2.21 golden case opportunity back 🤑🤑🤑

Let’s live in a world where we can shift the mix on a value package and see what the numbers look like.

In the scenarios above, you see in the top chart the current sales in CEs, Gross Dollars, and GP/CE of a value brand sold to an account. Think of the top as the current outcome with salespeople thinking “a box is a box.” Under this data and incentive structure, you are profiting an average of $3.54 in GP/CE for the packages.

In the bottom table, let’s look at what new data, incentive structure, and driving a behavior change can do for you.

We have made GP more of a priority, encouraged salespeople to make decisions based on GP/CE, and profitability has increased without increasing volume. These changes have taken advantage of the most profitable value packages for this operation.

Over this time period, this operation has moved the needle on a value brand to the tune of 6 cents per case. This has the ability to compound over and over again for this operation at scale and can pay out for years to come.

People respond to incentives and do the behavior you incentivize them to do 🧠🧠🧠

How you set up and track your incentives affects the way people respond. You absolutely can change the way your team thinks and sells your portfolio of products.

VXP is a real-time data analytics tool that your reps can use to make fast, informed decisions to sell more profitable products and positively impact your bottom line.

If you want your sales team to make you 6-20+ cents more per case (more profit without increasing volume), you need VXP.

Contact us today for a tour of this game-changing tool that will change the way you go to market, help you beat your competition, and make your operation more profitable.